- Tweet

- Tweet

Take our nominees poll, and download a printable ballot here

Polls

completed:

Take our nominees poll, and download a printable ballot here

Polls

completed:

New government figures show that flu cases seem to be leveling off nationwide. Flu activity is declining in most regions although still rising in the West.

The Centers for Disease Control and Prevention says hospitalizations and deaths spiked again last week, especially among the elderly. The CDC says quick treatment with antiviral medicines is important, in particular for the very young or old. The season's first flu case resistant to treatment with Tamiflu was reported Friday.

Eight more children have died from the flu, bringing this season's total pediatric deaths to 37. About 100 children die in an average flu season.

There is still vaccine available although it may be hard to find. The CDC has a website that can help.

___

CDC: http://www.cdc.gov/flu/

NEW YORK (Reuters) - Stocks have been on a tear in January, moving major indexes within striking distance of all-time highs. The bearish case is a difficult one to make right now.

Earnings have exceeded expectations, the housing and labor markets have strengthened, lawmakers in Washington no longer seem to be the roadblock that they were for most of 2012, and money has returned to stock funds again.

The Standard & Poor's 500 Index <.spx> has gained 5.4 percent this year and closed above 1,500 - climbing to the spot where Wall Street strategists expected it to be by mid-year. The Dow Jones industrial average <.dji> is 2.2 percent away from all-time highs reached in October 2007. The Dow ended Friday's session at 13,895.98, its highest close since October 31, 2007.

The S&P has risen for four straight weeks and eight consecutive sessions, the longest streak of days since 2004. On Friday, the benchmark S&P 500 ended at 1,502.96 - its first close above 1,500 in more than five years.

"Once we break above a resistance level at 1,510, we dramatically increase the probability that we break the highs of 2007," said Walter Zimmermann, technical analyst at United-ICAP, in Jersey City, New Jersey. "That may be the start of a rise that could take equities near 1,800 within the next few years."

The most recent Reuters poll of Wall Street strategists estimated the benchmark index would rise to 1,550 by year-end, a target that is 3.1 percent away from current levels. That would put the S&P 500 a stone's throw from the index's all-time intraday high of 1,576.09 reached on October 11, 2007.

The new year has brought a sharp increase in flows into U.S. equity mutual funds, and that has helped stocks rack up four straight weeks of gains, with strength in big- and small-caps alike.

That's not to say there aren't concerns. Economic growth has been steady, but not as strong as many had hoped. The household unemployment rate remains high at 7.8 percent. And more than 75 percent of the stocks in the S&P 500 are above their 26-week highs, suggesting the buying has come too far, too fast.

MUTUAL FUND INVESTORS COME BACK

All 10 S&P 500 industry sectors are higher in 2013, in part because of new money flowing into equity funds. Investors in U.S.-based funds committed $3.66 billion to stock mutual funds in the latest week, the third straight week of big gains for the funds, data from Thomson Reuters' Lipper service showed on Thursday.

Energy shares <.5sp10> lead the way with a gain of 6.6 percent, followed by industrials <.5sp20>, up 6.3 percent. Telecom <.5sp50>, a defensive play that underperforms in periods of growth, is the weakest sector - up 0.1 percent for the year.

More than 350 stocks hit new highs on Friday alone on the New York Stock Exchange. The Dow Jones Transportation Average <.djt> recently climbed to an all-time high, with stocks in this sector and other economic bellwethers posting strong gains almost daily.

"If you peel back the onion a little bit, you start to look at companies like Precision Castparts

The gains have run across asset sizes as well. The S&P small-cap index <.spcy> has jumped 6.7 percent and the S&P mid-cap index <.mid> has shot up 7.5 percent so far this year.

Exchange-traded funds have seen year-to-date inflows of $15.6 billion, with fairly even flows across the small-, mid- and large-cap categories, according to Nicholas Colas, chief market strategist at the ConvergEx Group, in New York.

"Investors aren't really differentiating among asset sizes. They just want broad equity exposure," Colas said.

The market has shown resilience to weak news. On Thursday, the S&P 500 held steady despite a 12 percent slide in shares of Apple after the iPhone and iPad maker's results. The tech giant is heavily weighted in both the S&P 500 and Nasdaq 100 <.ndx> and in the past, its drop has suffocated stocks' broader gains.

JOBS DATA MAY TEST THE RALLY

In the last few days, the ratio of stocks hitting new highs versus those hitting new lows on a daily basis has started to diminish - a potential sign that the rally is narrowing to fewer names - and could be running out of gas.

Investors have also cited sentiment surveys that indicate high levels of bullishness among newsletter writers, a contrarian indicator, and momentum indicators are starting to also suggest the rally has perhaps come too far.

The market's resilience could be tested next week with Friday's release of the January non-farm payrolls report. About 155,000 jobs are seen being added in the month and the unemployment rate is expected to hold steady at 7.8 percent.

"Staying over 1,500 sends up a flag of profit taking," said Jerry Harris, president of asset management at Sterne Agee, in Birmingham, Alabama. "Since recent jobless claims have made us optimistic on payrolls, if that doesn't come through, it will be a real risk to the rally."

A number of marquee names will report earnings next week, including bellwether companies such as Caterpillar Inc

On a historic basis, valuations remain relatively low - the S&P 500's current price-to-earnings ratio sits at 15.66, which is just a tad above the historic level of 15.

Worries about the U.S. stock market's recent strength do not mean the market is in a bubble. Investors clearly don't feel that way at the moment.

"We're seeing more interest in equities overall, and a lot of flows from bonds into stocks," said Paul Zemsky, who helps oversee $445 billion as the New York-based head of asset allocation at ING Investment Management. "We've been increasing our exposure to risky assets."

For the week, the Dow climbed 1.8 percent, the S&P 500 rose 1.1 percent and the Nasdaq advanced 0.5 percent.

(Reporting by Ryan Vlastelica; Additional reporting by Chuck Mikolajczak; Editing by Jan Paschal)

Diario el Informador, via Reuters

A rescue worker assisted a man injured during a riot at the Uribana prison in Barquisimeto, a northwestern city in Venezuela.

CARACAS, Venezuela — Dozens of people have been killed in fierce clashes between inmates and National Guard soldiers at a Venezuelan prison, local news media accounts said Saturday.

It was the latest in a series of bloody riots over the past year in overcrowded prisons here, where guns and drugs abound and inmates control many aspects of prison life.

Newspapers reported that more than 50 people had been killed at the Uribana prison in Barquisimeto, a northwestern city, citing the director of a hospital where the wounded and the dead were taken. The reports said that more than 80 people had been injured.

The minister of prisons, Iris Varela, said the violence broke out Friday when National Guard troops entered the prison to conduct an inspection, with the aim of taking weapons away from prisoners and establishing order.

“There was a tragic situation of confusion that we lament very much,” Vice President Nicolás Maduro said on television early Saturday. Mr. Maduro spoke after returning to Venezuela from Cuba, where he had gone to visit the country’s ailing president, Hugo Chávez, who has been out of sight since undergoing surgery in Havana for cancer more than six weeks ago.

Mr. Maduro is running the country in Mr. Chávez’s absence.

He described the prison as one of the country’s most dangerous, and he promised an investigation. “The prisons must be governed by the law,” he said.

There were conflicting reports about the episode but it appeared that inmates had resisted efforts by the National Guard to enter areas of the prison. The local news media reports indicated that some of the inmate bosses, known as prans, had been killed in the raid. The reports said that most of the dead were prisoners.

Ms. Varela said that two days before the raid the authorities received information of an increase in violence inside the prison, involving a settling of scores between different factions vying for control.

At that point, she said, the decision was made to have the troops enter the prison.

But she said that word of the operation leaked out and that it was reported by a television station, Globovision, on the Web site of a local newspaper and on social networking sites.

She called the reports “a detonator of the violence” and blamed them for setting off the riot inside the prison.

Last August, 25 people were killed and dozens were wounded in gunfights between inmates battling for control of the Yare I prison south of Caracas, according the official reports.

Also last summer, 30 people were killed in a prison riot in Merida, in the Andes Mountains, according the Venezuela Prison Observatory, a nongovernmental watchdog group. Outside the prison on Saturday morning a few hundred people, including many anguished relatives of prisoners, waited for news. Some sang the national anthem and some held signs that said “We want peace” and “No more deaths.”

“This happens all the time and nothing changes,” said Yolanda Rodríguez, 57, who was waiting for information about her 24-year-old son, an inmate in the prison. “We know nothing about what’s happening inside.”

Girish Gupta contributed reporting from Barquisimeto, Venezuela.

Earlier this week, images that were purportedly of Samsung’s (005930) upcoming Galaxy Note 8.0 tablet leaked onto the Web. The slate looked like an oversized Galaxy S III smartphone and included the company’s physical home button, which had perviously been omitted from earlier Galaxy tablets. French blog Frandroid posted additional images of the tablet on Friday that confirmed it will include an S-Pen stylus, similar to the Galaxy Note II and Galaxy Note 10.1.

[More from BGR: Sony’s PS Vita: Dead again]

[More from BGR: The Boy Genius Report: Apple’s iMac takes desktop crown]

The Galaxy Note 8.0 is rumored to be equipped with a 1280 x 800 pixel resolution display, 1.6GHz quad-core processor and a 5-megapixel rear camera. The slate is also believed to include 2GB of RAM, 16GB of internal storage, a microSD slot and Android 4.2.

Samsung is expected to announce the Galaxy Note 8.0 tablet next month at Mobile World Congress in Barcelona.

This article was originally published on BGR.com

Wireless News Headlines – Yahoo! News

01/25/2013 at 02:00 PM ET

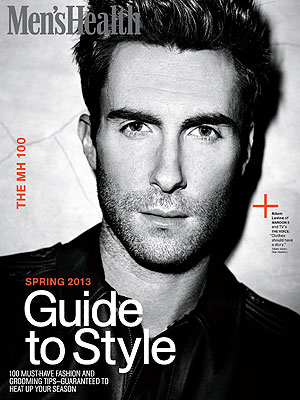

Courtesy Men’s Health

Courtesy Men’s Health

While some stars are repeat Fashion Faceoff offenders (we’re looking at you, Kim Kardashian), Adam Levine is determined to never be one of them. (Though the man really never should say never.)

In fact, his desire to have singular style is so strong that he won’t even pick up a plain old tee at a regular store for fear that another dude owns it. “I don’t want to buy a T-shirt and then go out to lunch and see someone else wearing the same thing,” Levine says in the new issue of Men’s Health. “I want my clothes to be unique. Not necessarily expensive, just one of a kind.”

So with that in mind, Levine puts a lot of thought into selecting those T-shirts. And even though they might look like basic Hanes to everyone else, what’s important to him is that he knows they’re not. The singer usually finds the tops at vintage shops because, “I also want them to have a story, a history, some meaning.”

In addition to his tees with history, the Maroon 5 frontman loves formalwear, saying, “[At] night I’ll throw on a suit and go out looking like a businessman.”

But it’s what he wears when he’s not on the red carpet or taping The Voice that really left us surprised — when he relaxes at home, Levine prefers something a bit, well, tighter. “I love waking up, throwing on some yoga pants, and hanging out all day looking like a psycho,” the singer reveals. His words, not ours.

For more Levine, pick up the March issue of Men’s Health, on newsstands Feb. 5. Tell us: Do you like Levine’s style? What do you think of guys wearing yoga pants?

Courtesy Men’s Health

Courtesy Men’s Health

–Jennifer Cress

PHOTOS: SEE MORE STAR STYLE IN ‘LAST NIGHT’S LOOK’

New government figures show that flu cases seem to be leveling off nationwide. Flu activity is declining in most regions although still rising in the West.

The Centers for Disease Control and Prevention says hospitalizations and deaths spiked again last week, especially among the elderly. The CDC says quick treatment with antiviral medicines is important, in particular for the very young or old. The season's first flu case resistant to treatment with Tamiflu was reported Friday.

Eight more children have died from the flu, bringing this season's total pediatric deaths to 37. About 100 children die in an average flu season.

There is still vaccine available although it may be hard to find. The CDC has a website that can help.

___

CDC: http://www.cdc.gov/flu/

NEW YORK (Reuters) - Stocks have been on a tear in January, moving major indexes within striking distance of all-time highs. The bearish case is a difficult one to make right now.

Earnings have exceeded expectations, the housing and labor markets have strengthened, lawmakers in Washington no longer seem to be the roadblock that they were for most of 2012, and money has returned to stock funds again.

The Standard & Poor's 500 Index <.spx> has gained 5.4 percent this year and closed above 1,500 - climbing to the spot where Wall Street strategists expected it to be by mid-year. The Dow Jones industrial average <.dji> is 2.2 percent away from all-time highs reached in October 2007. The Dow ended Friday's session at 13,895.98, its highest close since October 31, 2007.

The S&P has risen for four straight weeks and eight consecutive sessions, the longest streak of days since 2004. On Friday, the benchmark S&P 500 ended at 1,502.96 - its first close above 1,500 in more than five years.

"Once we break above a resistance level at 1,510, we dramatically increase the probability that we break the highs of 2007," said Walter Zimmermann, technical analyst at United-ICAP, in Jersey City, New Jersey. "That may be the start of a rise that could take equities near 1,800 within the next few years."

The most recent Reuters poll of Wall Street strategists estimated the benchmark index would rise to 1,550 by year-end, a target that is 3.1 percent away from current levels. That would put the S&P 500 a stone's throw from the index's all-time intraday high of 1,576.09 reached on October 11, 2007.

The new year has brought a sharp increase in flows into U.S. equity mutual funds, and that has helped stocks rack up four straight weeks of gains, with strength in big- and small-caps alike.

That's not to say there aren't concerns. Economic growth has been steady, but not as strong as many had hoped. The household unemployment rate remains high at 7.8 percent. And more than 75 percent of the stocks in the S&P 500 are above their 26-week highs, suggesting the buying has come too far, too fast.

MUTUAL FUND INVESTORS COME BACK

All 10 S&P 500 industry sectors are higher in 2013, in part because of new money flowing into equity funds. Investors in U.S.-based funds committed $3.66 billion to stock mutual funds in the latest week, the third straight week of big gains for the funds, data from Thomson Reuters' Lipper service showed on Thursday.

Energy shares <.5sp10> lead the way with a gain of 6.6 percent, followed by industrials <.5sp20>, up 6.3 percent. Telecom <.5sp50>, a defensive play that underperforms in periods of growth, is the weakest sector - up 0.1 percent for the year.

More than 350 stocks hit new highs on Friday alone on the New York Stock Exchange. The Dow Jones Transportation Average <.djt> recently climbed to an all-time high, with stocks in this sector and other economic bellwethers posting strong gains almost daily.

"If you peel back the onion a little bit, you start to look at companies like Precision Castparts

The gains have run across asset sizes as well. The S&P small-cap index <.spcy> has jumped 6.7 percent and the S&P mid-cap index <.mid> has shot up 7.5 percent so far this year.

Exchange-traded funds have seen year-to-date inflows of $15.6 billion, with fairly even flows across the small-, mid- and large-cap categories, according to Nicholas Colas, chief market strategist at the ConvergEx Group, in New York.

"Investors aren't really differentiating among asset sizes. They just want broad equity exposure," Colas said.

The market has shown resilience to weak news. On Thursday, the S&P 500 held steady despite a 12 percent slide in shares of Apple after the iPhone and iPad maker's results. The tech giant is heavily weighted in both the S&P 500 and Nasdaq 100 <.ndx> and in the past, its drop has suffocated stocks' broader gains.

JOBS DATA MAY TEST THE RALLY

In the last few days, the ratio of stocks hitting new highs versus those hitting new lows on a daily basis has started to diminish - a potential sign that the rally is narrowing to fewer names - and could be running out of gas.

Investors have also cited sentiment surveys that indicate high levels of bullishness among newsletter writers, a contrarian indicator, and momentum indicators are starting to also suggest the rally has perhaps come too far.

The market's resilience could be tested next week with Friday's release of the January non-farm payrolls report. About 155,000 jobs are seen being added in the month and the unemployment rate is expected to hold steady at 7.8 percent.

"Staying over 1,500 sends up a flag of profit taking," said Jerry Harris, president of asset management at Sterne Agee, in Birmingham, Alabama. "Since recent jobless claims have made us optimistic on payrolls, if that doesn't come through, it will be a real risk to the rally."

A number of marquee names will report earnings next week, including bellwether companies such as Caterpillar Inc

On a historic basis, valuations remain relatively low - the S&P 500's current price-to-earnings ratio sits at 15.66, which is just a tad above the historic level of 15.

Worries about the U.S. stock market's recent strength do not mean the market is in a bubble. Investors clearly don't feel that way at the moment.

"We're seeing more interest in equities overall, and a lot of flows from bonds into stocks," said Paul Zemsky, who helps oversee $445 billion as the New York-based head of asset allocation at ING Investment Management. "We've been increasing our exposure to risky assets."

For the week, the Dow climbed 1.8 percent, the S&P 500 rose 1.1 percent and the Nasdaq advanced 0.5 percent.

(Reporting by Ryan Vlastelica; Additional reporting by Chuck Mikolajczak; Editing by Jan Paschal)

Associated Press

Some recaptured crocodiles on South Africa's Rakwena Crocodile Farm on Wednesday.

JOHANNESBURG — About 15,000 crocodiles escaped from a South African reptile farm along the border with Botswana, a local newspaper reported Thursday.

Driving rains forced the Limpopo River over its banks on Sunday morning near the Rakwena Crocodile Farm. The farm’s owners, fearing that the raging floodwaters would crush the walls of their house, opened the gates, springing the crocodiles, the report said. About half of the reptiles have been captured, with thousands still on the loose.

“There used to be only a few crocodiles in the Limpopo River,” Zane Langman, whose father-in-law runs the farm, told the newspaper Beeld. “Now there are a lot.”

“We will catch them as the farmers call us and say there are crocodiles,” Mr. Langman was quoted as saying. Efforts to reach the farm and the local police directly were unsuccessful, with no one answering the phones.

Many of the captured crocodiles were found in the brush and orange groves that line the Limpopo. Most of the animals are captured at night, according to Mr. Langman, who said they were easier to spot because their eyes reflect light.

One of them was found on a school’s rugby field in Musina, nearly 75 miles from the farm.

During the floods Mr. Langman set out in a boat to rescue his neighbors. “You want to get them, but you wonder the whole time if you’ll make it there,” he said, according to the Beeld report. “When we reached them, the crocodiles were swimming around them. Praise the Lord, they were all alive.”

Recent flooding has killed at least 10 people in South Africa’s Limpopo Province, which has seen heavy rains for the past week. Local officials are recommending that some regions be declared disaster areas. The authorities in neighboring Mozambique have evacuated tens of thousands of people.

Both the South African and Zimbabwean air forces have had to rescue villagers in areas isolated by the floodwaters.

The land along the Limpopo is home to dozens of game reserves and crocodile farms, some housing tens of thousands of reptiles.

First announced in 2009, CCP Games’ online first-person shooter tie-in to its popular sci-fi MMO, EVE Online, was finally released as an open beta on Tuesday. Called DUST 514, it allows PlayStation 3 owners to play in the same world as EVE Online, fighting ground battles while EVE Online pilots contest star systems. The results of DUST 514 matches affect worlds and in-game corporations in EVE Online, and EVE Online players can even use starship weaponry to bombard the planets DUST 514 matches take place on.

Introducing New Eden

EVE Online and DUST 514 take place in a distant star cluster called New Eden. In a scenario sort of like ” Stargate” meets ” Star Trek: Voyager,” human space explorers found themselves trapped in New Eden, impossibly far from Earth, after using a one-way portal. Many thousands of years later, their descendants have formed completely new nations and ethnicities, and fight each other in space and on the ground over resources or ideology.

The most difficult MMO ever?

Widely regarded as very difficult — a popular infographic depicts EVE’s learning curve as a sheer cliff littered with stick figure bodies — EVE Online is also known for its byzantine politics, which take place completely between players. Player-run alliances sink years into building enormous spacecraft, which can vanish in a single battle or thanks to one person’s treachery.

A study in contrasts

DUST 514 is only available on the PlayStation 3 console, whereas EVE Online is for Windows PCs and Macs. DUST 514 is free to play and has no monthly fee, while EVE costs money to start and up to $ 14.95 per month (although there’s an expensive in-game item which can be used to offset this fee). But perhaps the biggest contrast is the level of commitment required. Instead of managing a whole spacecraft and needing to keep track of where it’s docked, DUST 514 players can just jump into instant battles, and are rewarded with experience and in-game currency each time.

Since the two games were linked together just a few weeks ago, however, EVE Online politics are beginning to affect DUST 514, and groups of players are getting drawn into its conflicts — or being sent by EVE in-game alliances to fight for them.

A work in progress

DUST 514 still bears the “beta” tag, and the end-user license agreement reminds players of this, even pointing out that CCP Games may choose to reset players’ gear and experience points at some time in the future. It has a very limited number of planet environments and only two styles of play, which basically amount to capture the flag and team deathmatch. CCP continues to develop DUST, however, promising that even more content will be available in the future.

Jared Spurbeck is an open-source software enthusiast, who uses an Android phone and an Ubuntu laptop PC. He has been writing about technology and electronics since 2008.

Linux/Open Source News Headlines – Yahoo! News

Copyright © News albigenses. All rights reserved.

Design  And Business Directories

And Business Directories